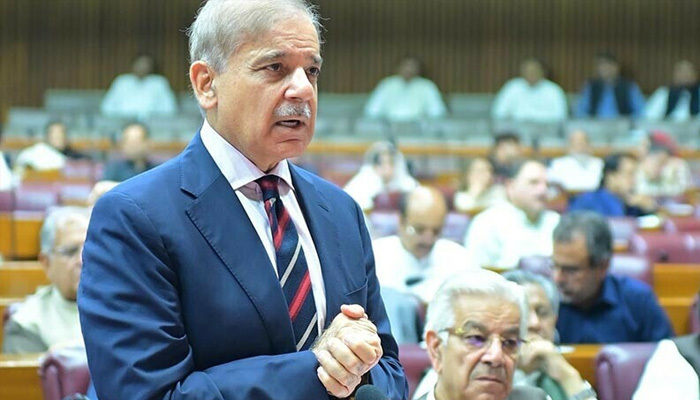

In a significant move, Prime Minister Shehbaz Sharif has approved stringent measures for tax enforcement and compliance, including a ban on all banking and financial transactions for non-filers of tax returns.

The Prime Minister has authorized Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial to submit proposals to the federal cabinet for expediting the implementation of the FBR Indigenous Transformation Plan, which was presented to him by Mr. Rashid and his team at the Prime Minister’s secretariat.

Over the past 40 days, more than 50 tax officers and experts collaborated to develop this transformation plan, which aims to address structural challenges hindering revenue growth. One key objective is to reduce the amount of cash currency in circulation, with Pakistan currently at 25%, compared to 14% in Bangladesh and India, and over 50% in Malaysia.

The Prime Minister noted that no additional revenue measures would be announced to achieve the estimated budget target of Rs12.970 trillion for FY25. Instead, these new steps will enhance existing budgetary measures and close loopholes related to income under-declaration.

The proposed strategy has three tiers based on reported income. Non-filers will be prohibited from acquiring cars, real estate, or financial instruments and will only be allowed to open basic Asaan Accounts. This is a significant policy shift aimed at documenting the economy.

Those declaring an income over Rs10 million will retain access to all benefits, while those reporting less than Rs10 million must explain their income sources for purchases. However, these individuals can still open bank accounts.

Currently, only 14% of manufacturers are registered for sales tax, with 86% unregistered. The outlook for income tax registration is similarly bleak, with just 25% of wholesalers and 8% of retailers registered.

The proposed documentation strategy includes disallowing sales input for unregistered entities and implementing digital invoicing to monitor unregistered purchasers. Notices will be issued to these entities, accompanied by severe penalties for noncompliance, including restrictions on utility services and freezing of bank accounts and property transactions.

The plan also suggests freezing the bank accounts of unregistered manufacturers, wholesalers, and distributors with annual turnovers exceeding Rs 250 million. For retailers, the accounts of those with turnovers above Rs100 million would also be frozen, both facing a new penalty of Rs1 million.

Incentives for tax officers will be based on integrity and performance, with a focus of 60% on integrity and 40% on performance, to be assessed quarterly. The FBR will establish integrity indexes for its officials.

In the initial phase of the plan, “efficient and competent officers” will be deployed in Karachi, which accounts for 32% of total tax collections, supported by auditors and specialists.

The Prime Minister praised the FBR’s restructuring strategy, emphasizing that improved tax collections will enhance service delivery and bolster the social sector, calling taxation the “backbone of the national economy.” He directed the FBR to engage with prominent taxpayers regarding the plan and coordinate with government departments for effective implementation, alongside conducting third-party audits of FBR projects and accelerating efforts to combat smuggling.